Authors: Sarah Mora Esquivel, Sebastian Krupke, Marcel Schröder, Abdel-Malik Maghraoui

Last updated: January 04, 2023

1 Definition

The term carbon accounting is widely used in several disciplines and is often used when it comes to integration of climate and environmental aspects into accounting. Still, the term is defined differently and there is no consistent definition 1Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.. Carbon accounting is a relatively new development and started among private companies in the late 1990s, promoted by the development of the Greenhouse Gas Protocol 2Brohé, A., The Handbook of Carbon Accounting. 2017: Taylor & Francis.. In the following Figure 1 different definitions for carbon accounting are given.

| Definition of Carbon Accounting | Source |

| „[…] Carbon accounting at the national scale can be summarized as the physical measurement and the non-monetary valuation of GHG emissions […]”. | Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. 3Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38., p. 29. |

| Carbon accounting is the accounting of greenhouse gas emissions and can be related to different accounting objects: to plants as in the case of the TEHG, to companies, to products and services or to entire supply chains. | Translated from: Schmidt, M., Carbon Accounting zwischen Modeerscheinung und ökologischem Verbesserungsprozess. Controlling & Management, 2010. 4Schmidt, M., Carbon Accounting zwischen Modeerscheinung und ökologischem Verbesserungsprozess. Controlling & Management, 2010. 54: p. 32-37., p. 32. |

| Carbon accounting involves obtaining the necessary information for recording CO2 values on products, services, or organizational units, but also corresponding target/actual comparisons. | Translated from: Eitelwein, O. and L. Goretzki, Carbon Controlling und Accounting erfolgreich implementieren – Status Quo und Ausblick. Controlling & management review: Zeitschrift für Controlling & Management, 2010. 5Eitelwein, O. and L. Goretzki, Carbon Controlling und Accounting erfolgreich implementieren – Status Quo und Ausblick. Controlling & management review: Zeitschrift für Controlling & Management, 2010. 54(1, (1/2)): p. 23-31., p. 25. |

The main point in several definitions is the measurement (or accounting) of emission values and the assignment of these to specific contexts. As seen in the literature review of Stechemesser and Guenther the evaluation of the emissions can be performed by monetary and non-monetary aspects. Furthermore, the carbon accounting can be performed on different scales: The organizational, national, project and product scale. 6Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

The emission values obtained by carbon accounting are used in carbon controlling. Carbon controlling is a part of environmental and sustainability controlling and includes the setting, achieving and control of goals designated to CO2 efficiency. 7Klein, A., Rechnungslegungstrends für Controller. 2012: Haufe Lexware.

1.1 Measurement and quantification

As contained within the term carbon accounting, it refers to carbon dioxide. As there are other greenhouse gases beside carbon dioxide, the measurement and accounting of greenhouse gases is carried out via a common unit, “[…] the ton of carbon dioxide equivalent […]” 8Bäckstrand, K., et al., Research Handbook on Climate Governance. Chapter 32: Carbon accounting. 2015: Edward Elgar Publishing., p. 366. The standardization of carbon dioxide equivalents (CO2 equivalents) emerged from the climate research and all greenhouse gases can be converted to CO2 equivalents by their global warming potential 9Schmidt, M., Carbon Accounting zwischen Modeerscheinung und ökologischem Verbesserungsprozess. Controlling & Management, 2010. 54: p. 32-37.. For instance, the greenhouse gases in the Kyoto Protocol can be converted to CO2 equivalents (see section Greenhouse Gas Effect and Climate Change).

1.2 Carbon accounting standards

Two popular carbon accounting standards are the Greenhouse Gas Protocol (GHGP) and the ISO 14064, which are closely related 10Spannagle, M. A Comparison of ISO 14064 Part 1 and the GHG Protocol Corporate Module. 2004 [cited 2022 09-10]; Available from: https://www.ecologia.org/ems/ghg/news/cop9/comparison.html..

The Greenhouse Gas Protocol (GHGP) is developed by a partnership between the World Resources Institute (WRI) and the Business Council for Sustainable Development (WBCSD). It is the most widely used standard for accounting of greenhouse gases 11GHG. About Us. 2022 [cited 2022 09-10]; Available from: https://ghgprotocol.org/about-us..

The GHGP contains accounting and reporting standards, tools for emission calculation, guidance for specific sectors and training material for business and local and national governments 12WRI. Greenhouse Gas Protocol. 2022 [cited 2022 09-10]; Available from: https://www.wri.org/initiatives/greenhouse-gas-protocol..

ISO 14064 is an international standard for greenhouse gases accounting that was published by the International Organization of Standardization. The standard provides governments, businesses etc. with a set of integrated tools for assessing and supporting greenhouse gas reduction and the emission trading 13ISO. ISO 14064-1:2018: Greenhouse gases — Part 1. 2018 [cited 2022 09-13]; Available from: https://www.iso.org/standard/66453.html..

1.3 Climate change and greenhouse gas effects

Main factor of the anthropogenic – human made – greenhouse gas effect is the increasing concentration of greenhouse gases in the atmosphere 14Klein, A., Rechnungslegungstrends für Controller. 2012: Haufe Lexware.. The main contributors to greenhouse gas effect are the greenhouse gases mentioned in the Kyoto Protocol from 1998, Annex A 15Breidenich, C., et al., The Kyoto Protocol to the United Nations Framework Convention on Climate Change. Am. j. int. law, 1998. 92(2): p. 315-331.:

- Carbon dioxide (C02)

- Methane (CH4)

- Nitrous oxide (N20)

- Hydrofluorocarbons (HFCs)

- Perfluorocarbons (PFCs)

- Sulphur hexafluoride (SF6)

The rise of earth’s average temperatures in the last years and the resulting climate change increased the public awareness for the global warming 16Klein, A., Rechnungslegungstrends für Controller. 2012: Haufe Lexware.. The protection of climate not only concerns politicians, but it also concerns the economy and consumers that are interested in their own climate footprint. 17Schmidt, M., Carbon Accounting zwischen Modeerscheinung und ökologischem Verbesserungsprozess. Controlling & Management, 2010. 54: p. 32-37.

2 History of carbon accounting

2.1. Historical background and relevance

Carbon accounting has emerged as an individual field of research in recent years. Initially, aspects of carbon accounting were studied as a component of environmental research. The roots of carbon accounting research and corporate practice can be traced back to the adoption of the Kyoto Protocol and to the appearance of government measures aim to influence how companies deal with greenhouse gas emissions (such as the EU Emissions Trading Scheme) 18He, R., et al., Corporate carbon accounting. Accounting and finance, 2022: p. 261-298..

At the country level, the need to compile annual inventories of greenhouse gas emissions had already started in 1994 with the effectiveness of the United Nations Framework Convention on Climate Change (UNFCCC). An international treaty to fight climate change 19UNFCCC. History of the Convention. 2022 [cited 2022 09-10]; Available from: https://unfccc.int/process/the-convention/history-of-the-convention#eq-1. , 20What is the United Nations Framework Convention on Climate Change? | UNFCCC. [cited 2022 09-14]; Available from: https://unfccc.int/process-and-meetings/the-convention/what-is-the-united-nations-framework-convention-on-climate-change.. Carbon accounting was then mandatory at the national level for all signatory countries. 21Ascui, F. and H. Lovell, As frames collide: making sense of carbon accounting. Accounting, Auditing & Accountability Journal, 2011. 24(8): p. 978-999. The first report of the Intergovernmental Panel on Climate Change (IPCC) in 1990 played an important role in the establishment of the UNFCCC. That report outlined the challenges and importance of climate change. Two years before the adoption of the Kyoto Protocol (1997), in 1995, the second IPCC Assessment Report was published. Governments thus had access to important information in preparation of the negotiations. The Kyoto Protocol aimed to intensify global efforts to combat climate change by binding signatory parties to set emission reduction targets. 22UNFCCC. History of the Convention. 2022 [cited 2022 09-10]; Available from: https://unfccc.int/process/the-convention/history-of-the-convention#eq-1. , 23IPCC. History. 2022 [cited 2022 09-14]; Available from: https://www.ipcc.ch/about/history/.

The importance of carbon accounting has not only increased at the national level, but also at the organizational level. During the last twenty years, carbon accounting has also become more important for companies. The focus and issues of carbon accounting at the organization level have transformed within this period. Csutora and Harangozó (2017) describe the development and transformation of carbon accounting in four phases. The first phase took place at the end of the 1990s until the beginning of the 2000s. The origins and history of the concept of carbon accounting are rooted in the emergence of environmental management accounting. During that first phase carbon accounting has served as an instrument of environmental management accounting. Carbon has been exemplary to cost or savings within environmental management accounting. At the corporate level, there has been increasing attention to environmental costs. The focus was on potential cost savings in resource use and improving eco-efficiency. Thematically, carbon accounting was not focused on as a separate topic area. This changed in the second phase, which according to Csutora and Harangozó (2017) was the predominant approach in the early and mid-2000s. At this time, carbon accounting became an area of focus within environmental accounting for the first time. This change occurred because of increased attention to climate change and increasing public interest in carbon emissions. The political and regulatory environment changed e.g., due to the Kyoto Protocol or the introduction of emissions trading in the EU. Companies are forced to address their carbon emissions to meet public expectations and fulfil political/regulatory pressure. 24Csutora, M. and G. Harangozo, Twenty years of carbon accounting and auditing – a review and outlook. Society and Economy, 2017. 39(4): p. 459-480.

Mandatory emissions rationing systems and carbon credit trading can potentially impact a company’s financial performance and value. Companies need to adjust their business actions to take advantage of rationing and trading or to avoid having to suffer disadvantages as a result of the system. 25Ratnatunga, J.T.D. and K.R. Balachandran, Carbon business accounting. Journal of accounting, auditing & finance, 2009.

In addition to the mandatory disclosure of carbon emissions, the first initiatives for voluntary disclosure of carbon emissions by e.g., organizations such as the Carbon Disclosure Project were also emerging within this period. Founded in 2000, today more than 2400 European companies report through the Carbon Disclosure Project. 26CDP. What CDP does. 2022 [cited 2022 09-07]; Available from: https://www.cdp.net/en/info/about-us/what-we-do.

Furthermore, in 2001 the first edition of the Corporate Standard of the GHG Protocol was issued. The corporate standard was intended to satisfy the growing need for an international standard for voluntary and mandatory GHG accounting and reporting. At present, the Greenhouse Gas Protocol provides the predominant/most widely used standard for the accounting of greenhouse gases. 27About Us | Greenhouse Gas Protocol. 2022 [cited 2022 09-12]; Available from: https://ghgprotocol.org/about-us.

Phase 3 as defined by Csutora and Harangozó (2017) begins in the mid-2000s and covers the transformation from carbon accounting of direct emissions to carbon accounting that also encompasses emissions related to purchased energy and emissions of the entire value chain (also see Chapter ´GHG Protocol and the Three Scopes`). There are still some methodological issues that have not yet been resolved, so phase 3 can be expected to be ongoing. In the fourth phase of carbon accounting the spectrum of this concept is wider. The broadening is due to the fact that not only carbon-containing greenhouse gases are considered, but also a large group of greenhouse gases and, in addition, that climate protection related costs and adaption costs are also addressed (also called climate change accounting). This last phase started in the 2010s and is currently gaining importance. 28Csutora, M. and G. Harangozo, Twenty years of carbon accounting and auditing – a review and outlook. Society and Economy, 2017. 39(4): p. 459-480. The importance of carbon accounting increased at this time in particular, also at the national level. With the conclusion of the Paris Agreement, the focus on climate change has once again intensified. The legally binding international agreement on climate change, adopted in 2015 by 196 contracting parties, aims to limit global warming to a level ideally below 1.5 degrees Celsius, but distinctly below 2 degrees. It was agreed that global emissions must peak as soon as possible and that limiting global warming would mitigate the effects of climate change. 29Europäische Kommission. Climate Action – Übereinkommen von Paris. [cited 2022 09-14]; Available from: https://ec.europa.eu/clima/eu-action/international-action-climate-change/climate-negotiations/paris-agreement_de.

2.2 Carbon pricing

Since the signing of the Kyoto Protocol, governments have also started to utilize government measures to influence the way organizations deal with greenhouse gas emissions. The measures were to create mechanisms so that emissions would be subject to financial costs for companies 30Bebbington, J. and C. Larrinaga-González, Carbon Trading: Accounting and Reporting Issues. European Accounting Review, 2008. 17(4): p. 697-717..

These mechanisms are summarized by the term carbon pricing. The two main types of carbon pricing are carbon tax and emissions trading schemes. The carbon tax predefines the price of carbon by setting a tax rate that organizations must pay for greenhouse gas emissions or the “carbon content of fossil fuels”. Under the emissions trading system, the overall level of total possible greenhouse gas emissions is predefined. The price of carbon is determined on the market by allocating so-called carbon allowances to market participants. Participants with higher emissions can either take measures to reduce emissions or purchase emission rights from other participants with lower emissions. 31The World Bank. Pricing Carbon. 2014 [cited 2022 09-13]; Available from: https://www.worldbank.org/en/programs/pricing-carbon.

3 Approaches

After analyzing the definition and the history of carbon accounting, the following chapter aims to provide a short but precise overview of the approaches for carbon accounting seen in prominent literature. This chapter will not focus on the GHG carbon protocol but will rather examine different approaches used by corporations and governments to measure their carbon emissions.

First and foremost, it is important to define what accounting in general means. Accounting in simplified terms tracks stocks and flows of specific units such as money, goods and so forth on a balance sheet that tracks the inflows and outflows of those mentioned units. It is highly important that those stocks and flows must be measured through standardized quantitative units for the accounting to be correct, rational and conclusive. In common sense, accounting is understood in a financial, economic sense, e.g., to establish financial statements for corporations but can evidently also be used to account for carbon dioxide emissions. 32Bäckstrand, K., et al., Research Handbook on Climate Governance. Chapter 32: Carbon accounting. 2015: Edward Elgar Publishing. In this sense carbon accounting can be seen as a subset of accounting that focuses on systems, methods and activities related to financial and ecological impacts caused by the development/changes of the environment and in this sense caused by the carbon emissions. 33Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38. In order to get a better understanding of the term carbon accounting, first the focus will lay on the term “environmental accounting” as defined by the United States Environmental Protection Agency (USEPA) to establish a framework for the following theories with the goal to then apply the concepts given by the USEPA onto carbon accounting specifically.

The USEPA names three different types of environmental accounting: national income accounting, financial accounting and managerial accounting.

The national income accounting approach measures emissions from a macro economic standpoint. It measures a nations consumption of renewable and non-renewable natural resource etc. using physical and monetary units. In this sense it can also be called “natural resources accounting”. Those reports are of relevance and interesting for citizens as well as politicians, corporations, NGOs and the general society. 34Prevention, U.S.E.P.A.O.o.P., Toxics, and I. Incorporated, An Introduction to Environmental Accounting as a Business Management Tool: Key Concepts and Terms. 1995: U.S. Environmental Protection Agency, Office of Pollution Prevention and Toxics.

The financial perspective of environmental accounting on the other hand only addresses a selected external audience like investors, creditors, tax authorities etc.). A corporation reports on their current economic state through their quarterly and annual reports which are being overlooked by responsible government agencies. 35Prevention, U.S.E.P.A.O.o.P., Toxics, and I. Incorporated, An Introduction to Environmental Accounting as a Business Management Tool: Key Concepts and Terms. 1995: U.S. Environmental Protection Agency, Office of Pollution Prevention and Toxics. Common worldwide standards like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards Foundation (IFRS) deliver the basic framework for those statements. 36Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

Managerial environmental accounting focuses on the identification, collection and analysis of information for internal purposes only. The main goal of managerial accounting is to provide a guideline and help to make incisive business decisions through collected data. Other than the information collected through the national income accounting and the financial accounting approaches, the information gathered by the managerial approach is and can only be relevant and for use for the corporation itself and no other entity or person. 37Prevention, U.S.E.P.A.O.o.P., Toxics, and I. Incorporated, An Introduction to Environmental Accounting as a Business Management Tool: Key Concepts and Terms. 1995: U.S. Environmental Protection Agency, Office of Pollution Prevention and Toxics.

After defining environmental accounting in a general sense, the concepts will now be applied to carbon accounting specifically. As previously mentioned Stechemesser & Guenther (2012) identified and developed four different scales of carbon accounting in their literature review: the organizational, project, product and national scale, while most literature focuses on the organizational scale. The organizational scale of carbon accounting can be realized by either voluntarily or mandatorily accounting for direct and indirect carbon emissions induced by organizations. Accounting can be done either in the monetary or non-monetary sense. 38Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38. Considering the framework established on basis of the USEPA, this means that if the carbon accounting is done for internal purposes only, it’s the case of carbon management accounting. If the accounting is done for external purposes, it’s the case of carbon financial accounting.

Other identified scales of carbon accounting are the project scale, the national scale and the product scale. 39Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

Carbon accounting on the national scale can be applied to the above-mentioned national income environmental accounting as defined by the USEPA. It is the physical measurement and the non-monetary valuation of carbon emissions either caused by either a whole nation or a specific area. These emissions can be caused by the inhabitants themselves or arise from natural disturbances. Analog, the target group of these reports is the whole nation, including their citizens, politicians, corporations etc. 40Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38. On the project scale carbon accounting means the measurement and non-monetary valuation of carbon emissions induced by a specific project. Afterwards those emissions will be evaluated from a monetary perspective in order “to inform investors and the respective project owners but also to establish standardized methodologies 41Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.. In this sense carbon accounting fulfills the same goal as financial environmental accounting and can be seen as a subsidiary category of it. The main difference is that the monetary perspective is only developed in the second stage of the report.

The product scale of carbon accounting focuses on measuring direct and indirect carbon emissions of products non-monetarily throughout their complete life cycle with the goal of reducing carbon emissions related to the specific product. The target groups are potential customers as well as existing customers and stakeholders. 42Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38. The product scale cannot be applied to a specific category given by the USEPA. It is rather a mixture of the financial and managerial environmental accounting approach since it reports to the corporation and their employees and product developers as well as to stakeholders of the company, such as investors, governments and customers.

The following Figure 2 illustrates the different scales of carbon accounting:

| Trait/Scale | Organizational | Organizational | Nation | Project | Product |

| Sub-Category | Carbon managerial accounting | Carbon financial accounting | |||

| Monetary/non-monetary measurement | Both | Both | Non-monetary | First non-monetary, then monetary | Non-monetary |

| Target audience | Internal | External: Tax authorities, investors | Society as a whole: citizens, politicians, corporations etc. | Investors. Project owners, Further research | Developing, company, (Product developers) Investors, customers, governments etc. |

| USEPA underlying concept | Environmental managerial accounting | Environmental financial accounting | Environmental National income accounting | Environmental financial accounting | Mixture of all |

It is important to mention that carbon accounting on all scales does not simply measure the stocks and flows of carbon emissions but requires many complex mathematical calculations, regardless of whether the accounting targets the monetary or non-monetary side. 44Bäckstrand, K., et al., Research Handbook on Climate Governance. Chapter 32: Carbon accounting. 2015: Edward Elgar Publishing. For example: Some accounting methods require national level baselines that must be established, which track past developments in carbon losses/gains over a given period in the past. Those baselines will then be compared to future developments in a future time period which is the key accounting period. 45Bäckstrand, K., et al., Research Handbook on Climate Governance. Chapter 32: Carbon accounting. 2015: Edward Elgar Publishing.

4 Practical implementation

4.1 Standards and frameworks

In the following, the implementation of the GHG Protocol and the three scopes will be addressed in more detail. The ISO 14064 standard is discussed, and the two tools are compared. The most important links to the standards are listed in the table below.

4.1.1 GHG Protocol and the three scopes

The GHG Protocol started 1998 to “address the need for a consistent and comparable framework for GHG reporting and is one of the most widely recognized standards for measuring GHG emissions today”. 46Yamamoto, J. What Are Scope 1, 2, and 3 Emissions? A quick guide to the GHG Protocol for calculating your carbon footprint. 2022 [cited 2022 09-13]; Available from: https://www.onetrust.com/blog/what-are-scope-1-2-3-emissions/. The general use of the Greenhouse Gas Protocol includes the six drivers of the greenhouse gas, determined by the Kyoto Protocol. These are sulphur hexafluoride, perfluorocarbons, hydrofluorocarbons, nitrous oxide, methane, and carbon dioxide. 47Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116. Additionally it is important to mention that certain other programs are capable to combined with the Greenhouse Gas Protocol. For example, there are many different voluntary GHG reduction programs and GHG registries such from the United States Environmental Protection Agency (EPA) or World Economic Forum Global GHG Registry. 48Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

The GHG Protocol addresses primarily business and their perspectives, but other organizations – like universities, state enterprises or non-governmental organizations (NGO’s) and City’s 49About Us | Greenhouse Gas Protocol. 2022 [cited 2022 09-12]; Available from: https://ghgprotocol.org/about-us. – are obliged themselves the use of certain guidelines. Altogether the Greenhouse Gas Protocol contains eleven Chapters of which chapter one, three, four, five and nine can be seen as standard guidelines. 50Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

On principle and to setting operational boundaries it is crucial to discover every direct or indirect emissions within the three so-called scopes. Scope 1 includes direct GHG emissions. Those emissions are trackable and are created by an individual like a company or an organization. 51ResourceCenter. What is the difference between direct and indirect emissions. 2016 [cited 2022 09-13]; Available from: https://www.buschsystems.com/resource-center/knowledgeBase/glossary/what-is-the-difference-between-direct-and-indirect-emissions. That can occur by the generation of electricity, heat or steam, physical or chemical processing, transportation products, waste, employees or materials and of intentional or unintentional releases in the production. 52Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116. Scope 2 included electricity indirect emissions. “Purchased electricity is defined as electricity that is purchased or otherwise brought into the organizational boundary of the company” 53Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.. Scope 3 includes any other indirect emissions. These emissions can happen by company activities, that are not directly connect or even owned. 54Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116. In the following Figure 4 the different scopes are recognizable.

| Mobility | Energy | Product | |

| Scope 1(direct) | Vans, cars(fuel, gas) | Gas, coal, oil(own production) | Direct emission during construction |

| Scope 2(indirect) | Vans, cars(hydro, electro) | Electricity, heat, stream(Third party production) | |

| Scope 3(indirect) | Corporate or customer travel(plane, train, helicopter) | Further emissions |

Then, another standard guidance is followed by setting organizational boundaries to consolidate GHG emissions. Due to necessary corporate reporting, there are two approaches about the mentioned matter: The equity share as well as the control approach. 56Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116. During the first one “a company accounts for GHG emissions from operations according to its share of equity in the operation” 57Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116. The second approach divides itself into financial and operations terms, which must be chosen by the company. In general companies account for the whole of 100 percent of the harming emission from that operation, they are in control. 58Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

When the consecutive setting of organizational and operational boundaries is finalized, the next issue is to track the emission over time. By the reason of the business nature, companies may change during the time by mergers, acquisitions and/or divestments et cetera. So by selecting a base year or an interval of a few years, companies are successfully able to compare future emissions. 59Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116. As just mentioned and due to the fact, that companies may experience structural or organizational changes, it occurs logical to reselect the base. The reason for that is to maintain the comparability between base years and future years. 60Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116. An example of this would be the energy group Endesa, that has recalculated its base year as it has sold its 87.5 % stake in Viesgo to the Italian energy group ENEL. 61Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

After participation in the BLICC program, the international home furniture retailer IKEA decided to include customer travel emissions as scope 3 emissions. The scope 3 emissions caused by IKEA’s business model – customer pick-up of furniture at the IKEA stores – were large relative to scope 1 and scope 2 emissions. IKEA conducted the calculation of emissions by customer transportation based on surveys at specific stores, asking for travel distances, customers per vehicle, possible access to public transportation etc. The results show that 66 percent of the emission inventory were due to customer travel, giving IKEA the insights to its influence on scope 3 emissions when developing new delivery services etc. 62Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

Best Practice Example: Scope 3 Emissions at IKEA

4.1.2 ISO 14064

ISO 14064, as a standard, was developed of the International Standard Organization, which is a non-governmental organization. In 2002 under the ISO 14000 series, which cover up the field of environmental management, ISO 14064 was established. It assist governmental agencies or other organizations. 63Wintergreen, J. and T. Delaney, ISO 14064, International Standard for GHG Emissions Inventories and Verification. 2007.

First and foremost, the general application for this norm is followed by five principles, which are necessary to constitute and maintain carbon accounting: relevance, transparency, consistency, accuracy, and completeness. 64DIN, DIN EN ISO 14064-1:2018. Treibhausgase –Teil 1: Spezifikation mit Anleitung zur quantitativen Bestimmung und Be-richterstattung von Treibhausgasemissionen und Entzug von Treibhausgasen auf Organisati-onsebene (ISO 14064-1:2018);. 2018, Beuth Verlag GmbH: Berlin. They are congruent with the GHG protocol.

ISO 14064 covers two types of emissions – direct and indirect greenhouse gas emissions. Direct emissions are those, which are mentioned earlier, and they are congruent with scope 1 of GHG Protocol. According to this norm, indirect emissions describe and unite scope 2 and scope 3 of GHG Protocol. 65DIN, DIN EN ISO 14064-1:2018. Treibhausgase –Teil 1: Spezifikation mit Anleitung zur quantitativen Bestimmung und Be-richterstattung von Treibhausgasemissionen und Entzug von Treibhausgasen auf Organisati-onsebene (ISO 14064-1:2018);. 2018, Beuth Verlag GmbH: Berlin. Additionally and important for report content, this ISO norm differentiate between required and recommended Information. It is required it is necessary to name the organization as well as a person who takes charge of the report. In addition, the time period should be specified and an organizational boundary should be defined. Reporting criteria are determined by the performing organization. In terms of quantification, all types of emission should be considered separately. This same applies for the indirect emission. Nevertheless, each type is stated in tons of CO2. To maintain the principles, it is quite important to select a base year. Any changes are explained. Hence, the selection of quantification approaches and their probable modifications are always followed by an explanation, as well as the description of uncertainties. 66DIN, DIN EN ISO 14064-1:2018. Treibhausgase –Teil 1: Spezifikation mit Anleitung zur quantitativen Bestimmung und Be-richterstattung von Treibhausgasemissionen und Entzug von Treibhausgasen auf Organisati-onsebene (ISO 14064-1:2018);. 2018, Beuth Verlag GmbH: Berlin.

As for the recommendations the organization describes general strategies, programs, and policies and as well as emission that occur outside of their boundaries. Further, emissions reported by respective facility, however a total presentation about all quantified GHG emission. In addition, it is useful to perform internal and external benchmark analysis, to assess past performances. Finally, it is useful to attach past reports to ensure comparability between them. 67DIN, DIN EN ISO 14064-1:2018. Treibhausgase –Teil 1: Spezifikation mit Anleitung zur quantitativen Bestimmung und Be-richterstattung von Treibhausgasemissionen und Entzug von Treibhausgasen auf Organisati-onsebene (ISO 14064-1:2018);. 2018, Beuth Verlag GmbH: Berlin.

Overall, between the GHG guidelines and the ISO 14064, there are only minor differences. In Regard of organizational boundaries, the GHG Protocol put up a wider guidance of the consolidation, whereas the ISO standard add the option of financial boundaries. Both differ slightly in terms of emissions. For example, the ISO classifies direct and indirect, while the GHG Protocol is known for its 3 scopes. 68Spannagle, M. A Comparison of ISO 14064 Part 1 and the GHG Protocol Corporate Module. 2004 [cited 2022 09-10]; Available from: https://www.ecologia.org/ems/ghg/news/cop9/comparison.html.

4.2 Financial carbon accounting

After examining the various approaches of carbon accounting and possible standards, the focus will now lay on financial accounting specifically, with the aim of presenting different methods that can be used to financially account for carbon emissions.

First and foremost, it must be mentioned that to this day there is no compulsory financial standard that an entity must follow while financially accounting for carbon emissions. No specific standards are set by the governing bodies like the International Financial Reporting Standards Foundation (IFRS), Generally Accepted Accounting Principles (GAAP) or International Accounting Standards Board (IASB), hence in practice many different approaches and methods are used. 69Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38. While financially accounting for emissions several questions need to be answered: Will the emission allowances be regarded as Intangible assets or inventory assets; Will the emissions be initially recorded as costs or fair value; how can the liability of emissions be estimated and measured; and so forth. 70Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

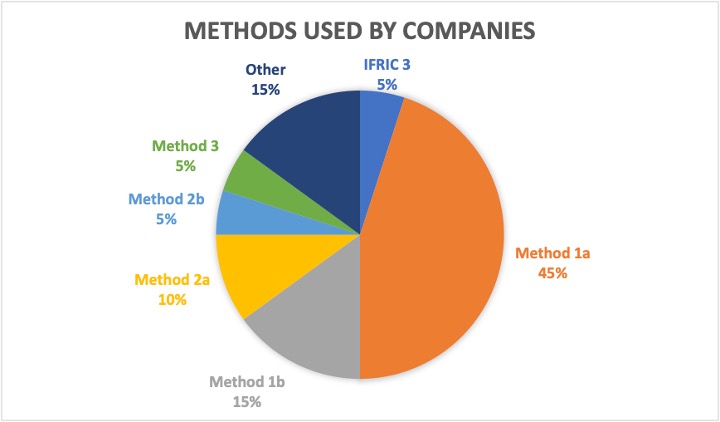

To answer all these questions many kinds of approaches are being used in practice. The first approach to give a guideline for financially accounting for emissions was the ‘International Financial Reporting Interpretations Committee (IFRIC) 3 Emissions Rights’ Standard, issued in 2004 by the IASB as answer to the Kyoto Agreement. 71AASB, Approaches to Recognition and Measurement of Emission Liabilities arising from Emission Trading Schemes. 2013. The IFRIC 3 Standard stated that emissions ought to be regarded as intangible assets in financial statements in accordance with the International Accounting Standards (IAS) 38 and IAS 37 standards. However, shortly after issuing this standard it was withdrawn in June 2005 because of several accounting mismatches that did not represent economic reality. 72IAS Plus. IASB withdraws IFRIC 3 ‘Emission Rights’ IAS Plus 2005 [cited 2022 09-10]; Available from: https://www.iasplus.com/en/news/2005/June/news2147 After the withdrawal of IFRIC 3 several attempts have been made to establish a global financial accounting standard for emissions, however none of them were successful or had to be abandoned due to resource constraints. 73Dara, N.P., Jane, Emissions trading schemes: Summary of accounting issues 2014. Therefore, a wide variety of interpretations of the current IAS Standards are being used in practice to account for emissions. A survey from PricewaterhouseCoopers (PwC) and the International Emissions Trading Association (IETA) conducted in 2007 investigated the different accounting approaches used by companies that participate in the European Union Emissions Trading System (EU-ETS). 74IETA, Trouble-Entry Accounting – Revisited: Uncertainty in accounting for the EU Emissions Trad-ing Scheme and Certified Emission Reductions. 2007. The EU-ETS is the key instrument of the European Union (EU) climate change policy and uses a cap-and trade system, which uses so called “allowances” that are treated as commodities (see also section 2.2 ´Carbon pricing`). These allowances can either be issued to the participants by the EU (Figure 5: ‘granted allowances’) or bought on the EU-Carbon market by the participants. (Figure 5: ‘purchased allowances’). Participants in the EU-ETS include power plants, industrial plants, airlines, and other large energy consumers. The EU lowers the cap each year to meet the emission reduction target. 75The EU Emissions Trading System. 2022 [cited 2022 09-12]; Available from: https://www.epa.ie/our-services/licensing/climate-change/eu-emissions-trading-system-/. Each allowance equals one ton of CO2. 76European Comission. Emissions cap and allowances. 2021 [cited 2022 09-11]; Available from: https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets/emissions-cap-and-allowances_en. The following Figure 5 summarizes the PwC and IETA survey and shows the different methods used by the 26 participating organizations.

| Initial recognition | Obligation recognition | Balance valuation | |

| IFRIC | Recognize granted allowances at fair value when received | recognized in deferred income on the balance sheet. | Prevailing Market price |

| Method 1a | Recognize granted allowance at nil value | recognized at the carrying value for allowances already granted/purchased | Prevailing market price |

| Method 1b | Recognize granted allowance at nil value | Recognized at the carrying value for allowances already granted/purchased, then at the relevant contract price for allowances to be purchased under forward purchase contracts | Prevailing market price |

| Method 2a | Recognize granted allowance at fair value | Recognized at the carrying value for allowances already granted/purchased | Prevailing market price |

| Method 2b | Recognize granted allowance at fair value | Obligation recognized at the carrying value for allowances already granted/purchased, and at the relevant contract price for allowances to be purchased under forward purchase contracts | Prevailing market price |

| Method 3 | Recognize granted allowance at fair value | full obligation valued at market price | Prevailing market price |

Six main approaches were identified. 78IETA, Trouble-Entry Accounting – Revisited: Uncertainty in accounting for the EU Emissions Trad-ing Scheme and Certified Emission Reductions. 2007. Figure 6 shows that the most method with over 45% by participants was Method 1a. However, 15% of the participants use different methods that are not included in the table due to their complexity and diversity which makes it impossible to classify them. 79IETA, Trouble-Entry Accounting – Revisited: Uncertainty in accounting for the EU Emissions Trad-ing Scheme and Certified Emission Reductions. 2007. In total fifteen different approaches were identified. 80IETA, Trouble-Entry Accounting – Revisited: Uncertainty in accounting for the EU Emissions Trad-ing Scheme and Certified Emission Reductions. 2007.

For further reference and guidance, the accounting firm Ernst & Young published a report that shows other approaches that organizations can use to financially account for carbon emissions. 81Ernst & Young. Applying IFRS – Accounting for Climate Change (Updated May 2022). 2022 [cited 2022 09-08]; Available from: https://www.ey.com/en_gl/ifrs-technical-resources/applying-ifrs-accounting-for-climate-change-updated-may-2022.

In conclusion it can be clearly seen that many different approaches and methods are being used to account for carbon emissions, which makes it incredibly hard to compare financial reports from different companies. 83Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38. The lack of an international standard makes it necessary for companies to explain their emission accounting practices to investors and other stakeholders in order to support the transparency and the accuracy of the reports. 84Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38. It is evident that there is a huge need for a consistent, comprehensive and compulsory method for organizations to effectively financially account for carbon emissions.

4.3 Physical carbon accounting

After this article has taken a closer look at the financial carbon accounting approaches. This section looks at the methods for assessing corporate carbon emissions.

The techniques Life Cycle Assessment, Environmental extended input-output analysis and hybrid approaches are considered.

4.3.1 Life Cycle Analysis

Life Cycle Analysis (or Life Cycle assessment) is applied to gain knowledge of the environmental or ecological damage, that emerge from certain products along the entire production 85Fischer, S., Hartmann, T., Hell, C. & Krause, G. , Mehr Wert? Eine Untersuchung von Nutzen und Kosten eines Klimareportings durch deutsche Unternehmen. WWF Deutschland. CDP Driving Sustainable Economics. 2016.. Simply this tool comprises all the activities that go into producing, making, using and possibly even up to wasting a product. 86Jensen, A., et al., Life cycle assessment (LCA) – a guide to approaches, experiences and information sources. 1998. Also Jolliet et al. stated, that “[the Life Cycle Analysis] helps identify where environmental improvements can be made in a product’s life cycle and aids in the designing of new products.” 87Jolliet, O., et al., Environmental Life Cycle Assessment. 2015. The steps of the Life Cycle Analysis are shown in Figure 7. It is important to keep in mind, that any evaluations according to this figure and to the general analysis are subjective. Nevertheless, it is a very helpful modeling tool to quantifying ecological or environmental impacts of processes and products. 88Eckelman, M.N. Life Cycle Assessment Explained. 2022 [cited 2022 09-08]; Available from: https://stich.culturalheritage.org/life-cycle-assessment-explained/.

The first step in the use of this analysis is to set the main goal as well as the scope. This is helpful for further evaluations. It is important that certain includes and even excludes are in considerations, due to the fact, that some factors might not be necessary because they would distort the outcome. For example, it is significant for smartphone producers to include the whole supply chain and the logistics or transportations of the individual product parts up to the actual sale in the store. But it is wise to exclude the emissions associated with building the roads that are used to transport product parts. It depends on the wishes of the client how much emissions are considerable to report, which is again subjective. 90Eckelman, M.N. Life Cycle Assessment Explained. 2022 [cited 2022 09-08]; Available from: https://stich.culturalheritage.org/life-cycle-assessment-explained/.

The second step contains the collection of data, which can be a complex matter to fulfil. The third step is the result of the date collection and it’s showing the actual impact on each flow during the supply chain. In the end there is the crucial part of interpretation. Knowledge-gain followed by actual recommendations is the key. Corporate or business goals are influenced by the results of this analysis. 91Eckelman, M.N. Life Cycle Assessment Explained. 2022 [cited 2022 09-08]; Available from: https://stich.culturalheritage.org/life-cycle-assessment-explained/.

4.3.2 Environmental extended input-output analysis

Since the life cycle assessment cannot include or cover the full process flow, it is necessary to have models referring to the environmental extended input-output analysis. 92Tukker, A., et al., Environmentally extended input-output tables and models for Europe, in None (EN). 2006, European Commission, Joint Research Centre, Institute for Prospective Technological Studies. Therefore these analysis evaluate the environmental impact caused by economic activities such as by consumption or by production. By calculating the tools can be used to reveal “hidden, upstream, indirect or embodied (these words are often used interchangeably) environmental impacts associated with a downstream consumption activity” 93Kitzes, J., An Introduction to Environmentally-Extended Input-Output Analysis. Resources, 2013. 2: p. 489-503.. In general, this analysis is created on a state level. 94Schaffartzik, A., Sachs, M., Wiedenhofer, D. & Eisenmenger, N., Environmentally Extended Input-Output Analysis. Social Ecology Working Paper 154., 2014.

The requirements of the environmental extended input-output analysis data or information about direct costs, externalities, that cause ecological damage. In the end an input-output chart will be created, that lead to certain instructions for action. 95Lugschitz, B., S. Giljum, and F.S. Lutter, Ein neuer Ansatz des Umweltrechnungswesens. Ökologisches Wirtschaften – Fachzeitschrift, 2011. 25: p. 36.

As for boundaries, current mathematical calculations in the States of the European Union are not uniform to enable harmonization. Hence the comparability is not given. This situation makes it difficult to quantify the extent to which a country is offloading environmental impacts through trade. However, for reasons of complexity, existing studies tend to aggregate sectors and regions and only focus on a very small number of environmental impacts. In practice an overall environmental impact by state, which is comparable and calculated by the same method as every other state nonexistent. 96Lugschitz, B., S. Giljum, and F.S. Lutter, Ein neuer Ansatz des Umweltrechnungswesens. Ökologisches Wirtschaften – Fachzeitschrift, 2011. 25: p. 36.

4.3.3 Hybrid approaches

The general hybrid approach combined the advantages of both the Life Cycle Assessment and the Environmental Extended input-output Analysis. While the first mentioned is used to analyze each step little by little, second one is to determine all energy flows, that exceed the process boundaries. Within this hybrid approach there are 4 types: tiered, input-output based, integrated and augmented process-based. 97Bilec, M., A Hybrid Life Cycle Assessment Model for Construction Processess. 2007.

The tiered approach is meant to be on a macro level, where “the cost of a product is multiplied by the energy intensity per unit gross domestic product (GDP)” 98Bilec, M., A Hybrid Life Cycle Assessment Model for Construction Processess. 2007.. To increase specificity of this approach, it is necessary to increase tiers of detail or levels by making associations between parts of the product system to a particular input-output system. Hence, the energy requirements of typical products can be determined directly from the input-output sector and factors of energy use. Using the certain tiers to specify results is a disadvantage of the model, because those insertion are subjective. Although “all investigation levels include adjustments for margins of error, budget uncertainty, and energy intensity uncertainty” 99Bilec, M., A Hybrid Life Cycle Assessment Model for Construction Processess. 2007., those adjustments are for the most part input-output data. 100Bilec, M., A Hybrid Life Cycle Assessment Model for Construction Processess. 2007.

The second hybrid input-output based approach, mainly disaggregate sectors based on detailed economic information. According to Josh, there are three models to differ. The first model is to approximate the product by its sector. “Direct and indirect effects of incremental output of a particular product can then be estimated by treating it as a change in exogenous demand for the output of the sector” 101Joshi, S., Product Environmental Life-Cycle Assessment Using Input-Output Techniques. Journal of Industrial Ecology, 1999. 3(2-3): p. 95-120.. Because of this simplicity, there is less use of data and it is easy to calculate, as well as a first screening advise to further data prioritization. 102Joshi, S., Product Environmental Life-Cycle Assessment Using Input-Output Techniques. Journal of Industrial Ecology, 1999. 3(2-3): p. 95-120. The second model is used to conduct a Life Cycle Assessment of a product, that is already existing or a completely new product. If the information about the input of the new product, as well as the (potentially) environmental effect, are available, then the certain new product can be seen as new hypothetical sector entering the economy. 103Joshi, S., Product Environmental Life-Cycle Assessment Using Input-Output Techniques. Journal of Industrial Ecology, 1999. 3(2-3): p. 95-120. Modell three sets a framework to disaggregate an existing industry sector. “The advantages of this [model] are that detailed process information can be included without double counting and the framework is presented in a consistent manner” 104Bilec, M., A Hybrid Life Cycle Assessment Model for Construction Processess. 2007.. Model four disaggregate iterative, when a limited conventional life cycle analysis is available. Hence it is an extended version of the previous mentioned model and can be filled with more detailed information, if they are available on more on one stage of upstream input 105Bilec, M., A Hybrid Life Cycle Assessment Model for Construction Processess. 2007..

As for the integrated approach, in a mathematical framework, processed-based Life Cycle Analysis is combined with input-output analysis, while the input-output remain in monetary units, the processed-based data describes itself in physical units. Belic stated, “[t]he process-based and [input-output] data for an integrated hybrid model is linked through a make and use framework that is connected through the flows at the boundary of each system.” 106Bilec, M., A Hybrid Life Cycle Assessment Model for Construction Processess. 2007.

Last, the augmented process-based approach and its results are similar to the mentioned model four, because it uses input-output data, as well as incorporate detailed process-based framework and integrate missing processes with process data. The difference is the extended use, by modeling the life cycle inventory for also temporary fabrics or materials like electricity and fossil fuel use in operations phases and continuous maintenance materials. 107Bilec, M., A Hybrid Life Cycle Assessment Model for Construction Processess. 2007.

5 Drivers and barriers

5.1 Drivers

After this article examined the practical implementation of carbon accounting in detail, the next step is to consider the motivation for its application and the driver/determinants of carbon accounting. As can be seen from the “Definition” section, there is no generally accepted definition of “carbon accounting”. To analyze the drivers and motivations behind carbon accounting, it is therefore necessary to review different aspects of the term carbon accounting. Referring to measurement, this article looks at the motivation for collecting data and compiling a greenhouse gas inventory. In the next step it is necessary to look more specifically at carbon accounting by taking a closer look at two major streams of the literature of carbon accounting: carbon management and carbon disclosure. Carbon management as identifying the sources and underlying reasons for carbon emissions within an organization and then minimizing them. Carbon disclosure for the disclosure of carbon-related information – voluntarily or mandatory. 108He, R., et al., Corporate carbon accounting. Accounting and finance, 2022: p. 261-298. , 109Zhou, S., Carbon Management Concepts. 2020. p. 91-121.

5.1.1 General motivation

Companies collect greenhouse gas data and compile inventories to achieve certain targets. The Corporate Accounting and Reporting Standard of the GHG Protocol lists five frequently cited corporate goals in this regard 110Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.:

- (1) Companies prepare greenhouse gas inventories for example to identify greenhouse gas risks and to identify potential to reduce emissions.

Risks and opportunities of future GHG constraints, e.g., measures by governments to reduce GHG emissions, need to be anticipated and managed by companies to compete in the business environment in the long term. Not managing GHG risks, e.g., unaccounted emissions within the value chain, can for example cause increased costs or reduced revenues for companies in the future. For this reason, it is important for companies to know their overall emissions profile and to be able to identify opportunities to reduce emissions. Furthermore, the GHG inventory is required for the purpose of setting GHG targets, with subsequent measurement and reporting. - Furthermore, companies compile greenhouse gas inventories to use them for public reporting or voluntary greenhouse gas programs. Various stakeholders increasingly expect companies to provide more comprehensive disclosure regarding their greenhouse gas information. Companies can meet this expectation, for example, by voluntarily reporting on the issue to stakeholders or by participating in voluntary greenhouse gas reporting programs.

- In addition to voluntary reporting to stakeholders and voluntary participation in greenhouse gas programs, there are companies that are required to participate in mandatory reporting programs. This is regulated by several governments, which stipulate this as mandatory for certain emitters of greenhouse gases.

- Another motivation for collecting information and compiling a GHG inventory is participation in GHG markets. Such as participation in voluntary or mandatory emissions trading programs.

- In addition, the idea that early action pays off for companies can serve as a motivation for collecting information and compiling a voluntary GHG inventory. Should governmental regulatory programs be introduced in the future, previous voluntary emission reductions may be recognized in these regulatory programs. 111Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

5.1.2 Specific drivers

Carbon management

There are several factors that can have an impact on a companies’ approach to carbon management. Csutora and Harangozó (2017) group motivations behind carbon management at the organizational level into three categories. A company’s motivation can be regulatory-driven, efficiency-driven, or market-driven. Regulatory-driven when stricter regulations require companies to implement carbon accounting in certain areas of the business. Efficiency-driven, when the focus is on cost savings by reducing carbon emissions, or market-driven, when stakeholders are interested in carbon issues and as a result carbon accounting is integrated into e.g., the field of marketing. 112Csutora, M. and G. Harangozo, Twenty years of carbon accounting and auditing – a review and outlook. Society and Economy, 2017. 39(4): p. 459-480.

Okereke (2007) analyses the two factors ‘motivation’ and ‘drivers’. Motivation refers to factors that have developed from within the company itself, i.e., motivations of a company have not been influenced by the external environment. In contrast, drivers describe factors that exert external pressure on companies and could influence courses of action. Motivations related to carbon management are profit, credibility and climate policy influence, risk prevention, ethical considerations and, in addition, fiduciary duties regarding long-term impacts of climate change affecting the company. As driver Okereke (2007) identified inter alia regulation and government policies. 113Okereke, C., An Exploration of Motivations, Drivers and Barriers to Carbon Management. European Management Journal, 2007. 25(6): p. 475-486.

Regulation/regulatory pressure is often mentioned in the literature as a factor that affects the implementation of corporate carbon management 114Okereke, C., An Exploration of Motivations, Drivers and Barriers to Carbon Management. European Management Journal, 2007. 25(6): p. 475-486. , 115Kumarasiri, J. and C. Jubb, Carbon emission risks and management accounting: Australian evidence. Accounting Research Journal, 2016. 29(2): p. 137-153. , 116Bui, B., L. Chapple, and T.P. Truong, Drivers of tight carbon control in the context of climate change regulation. Accounting & Finance, 2020. 60(1): p. 183-226. Pressure, due to a changed regulatory environment since the signing of the Kyoto Protocol and introduction of government measures aimed at influencing the way companies deal with greenhouse gas emissions (such as mandatory emissions trading and carbon taxes, also see section: ´Carbon pricing`) 117He, R., et al., Corporate carbon accounting. Accounting and finance, 2022: p. 261-298. , 118Zhang, K., et al., A bibliometric analysis of research on carbon tax from 1989 to 2014. Renewable and Sustainable Energy Reviews, 2016. 58: p. 297-310..

Kumarasiri and Jubb (2016) find that potential financial risks from regulatory requirements, prompt managers to pay attention to emission information and to potentially increase the use of accounting techniques 119Kumarasiri, J. and C. Jubb, Carbon emission risks and management accounting: Australian evidence. Accounting Research Journal, 2016. 29(2): p. 137-153.. Bui et. al (2020) state that the economic and regulatory environment is one of the most important drivers of tight budget controls. 120Bui, B., L. Chapple, and T.P. Truong, Drivers of tight carbon control in the context of climate change regulation. Accounting & Finance, 2020. 60(1): p. 183-226.

In addition to the legal perspective, there are factors that have an influence on carbon management from the market and technology perspective. Companies need to incorporate significant market changes that are emerging in the context of climate change into their strategic decisions in order to remain competitive. Thus, market changes, such as changing customer preferences for e.g., sustainable energy supply concerning energy utilities, are driving the use of carbon management in these kinds of companies. Moreover, technological change is an important driver. Technological innovation as a way to reduce production costs and gain competitive advantage (or protect against competitive disadvantage) by reducing greenhouse gas emissions and decreasing dependence on traditional industries. 121Okereke, C., An Exploration of Motivations, Drivers and Barriers to Carbon Management. European Management Journal, 2007. 25(6): p. 475-486.

An important driver in this context is also energy prices. Companies are dependent on energy. Even if the company’s energy use is not particularly high, there are interrelationships with other companies, which means that indirect threats from high energy prices can still exist. 122Okereke, C., An Exploration of Motivations, Drivers and Barriers to Carbon Management. European Management Journal, 2007. 25(6): p. 475-486.

Another driver that is also mentioned in the literature is the change in awareness of climate change and the associated pressure from stakeholders. In this context, Bui et al. (2020) find that stakeholder pressure is an important driver for the introduction of carbon management, but it does not necessarily determine the extent to which management control systems are used. 123Bui, B., L. Chapple, and T.P. Truong, Drivers of tight carbon control in the context of climate change regulation. Accounting & Finance, 2020. 60(1): p. 183-226.

In addition to the above-mentioned drivers, which reflect a company-external view, there are company-internal drivers of carbon management. An important internal driver is the size of a company. Larger companies tend to exercise more carbon control. 124Bui, B., L. Chapple, and T.P. Truong, Drivers of tight carbon control in the context of climate change regulation. Accounting & Finance, 2020. 60(1): p. 183-226. Of additional relevance is the degree of importance that companies associate with carbon issues. The extent to which carbon controls are applied depends mainly on management’s strategic awareness and responsiveness 125Bui, B., L. Chapple, and T.P. Truong, Drivers of tight carbon control in the context of climate change regulation. Accounting & Finance, 2020. 60(1): p. 183-226..

Carbon disclosure

In addition to carbon management, there is extensive research on the drivers of carbon reporting. Regulation is also a significant driver of transparency in carbon reporting. The stringency of environmental regulations and emissions trading schemes are driving companies to disclose carbon information.19 In addition to regulation, pressure from non-governmental organizations is driving companies to disclose information, such as the work of the Carbon Disclosure Project. 126Knox-Hayes, J. and D.L. Levy, The politics of carbon disclosure as climate governance. Strategic Organization, 2011. 9(1): p. 91-99.

Internal company drivers include company size, leverage and the greenhouse gas intensity of the industry. Larger, more indebted companies in an industry with high greenhouse gas intensity tend to disclose more carbon information. 127Tang, Q. and L. Le, Corporate ecological transparency: theories and empirical evidence. Asian Review of Accounting, 2016. 24(4): p. 498-524.

Rankin et al. (2011) also find that voluntary reporting of GHG emissions is undertaken by companies that have implemented an environmental management system and also have a higher quality of corporate governance. 128Rankin, M., C. Windsor, and D. Wahyuni, An investigation of voluntary corporate greenhouse gas emissions reporting in a market governance system. Accounting, Auditing & Accountability Journal, 2011. 24(8): p. 1037-1070.

In summary, a variety of drivers can be found within the research streams of carbon accounting. The most frequently mentioned firm-external driver, which is likely to have the greatest influence, is regulatory pressure. The presumed most important firm factor is the size of the firm.

5.2 Barriers

There are different barriers in the field of carbon accounting. An important barrier in financial carbon accounting, for example, is the lack of a uniform international standard for the treatment of carbon allowances. For companies, the lack of such a standard can create costs if the GHG inventory is not able to meet different information requirements (whether external or/and internal). In addition to this, a uniform standard would, among other things, improve consistency of data and thus maintain adequate comparative measurement over time. 129Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

Zhang et al. (2016) identify the lack of a standard definition for carbon accounting as the main factor hindering the development of such a standard. 130Zhang, C.-P., C.-Z. Zhang, and M. Zhou, Rethinking on the Definition of Carbon Accounting, in International Conference on Modern Economic Development and Environment Protection (ICMED 2016. May 28-29, 2016, Chengdu, China. 2016, DEStech Publications Inc: Lancaster, Pennsylvania U.S.A.

Furthermore, double counting is a barrier of effective carbon accounting. Double counting in the sense that the same emissions are included in the carbon inventory of two different companies. There are different sources of this problem, e.g. the different global emissions trading systems and their respective requirements for the inclusion of, for example, scope 3 emissions. 131Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

Companies may therefore lack the knowledge to prevent doubling counting.

Other obstacles are the different legal frameworks and national regulations. There is a lack of a guiding legal framework that enables companies to implement long-term carbon strategies. A secure framework that sets the future course of governments on climate actions to avoid uncertainty for companies 132Okereke, C., An Exploration of Motivations, Drivers and Barriers to Carbon Management. European Management Journal, 2007. 25(6): p. 475-486.. This means that companies lack incentives to pursue carbon accounting efforts.

Company-internal barriers can be the perception of business opportunities and risks related to climate change, by the management of companies. Lack of awareness 133Herbohn, K., P. Dargusch, and J. Herbohn, Climate Change Policy in Australia: Organisational Responses and Influences. Australian Accounting Review, 2012. 22(2): p. 208-222. and management incentives 134Tang, Q. and L. Le, Corporate ecological transparency: theories and empirical evidence. Asian Review of Accounting, 2016. 24(4): p. 498-524. can hinder sustainable implementation.

References

- 1Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 2Brohé, A., The Handbook of Carbon Accounting. 2017: Taylor & Francis.

- 3Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 4Schmidt, M., Carbon Accounting zwischen Modeerscheinung und ökologischem Verbesserungsprozess. Controlling & Management, 2010. 54: p. 32-37.

- 5Eitelwein, O. and L. Goretzki, Carbon Controlling und Accounting erfolgreich implementieren – Status Quo und Ausblick. Controlling & management review: Zeitschrift für Controlling & Management, 2010. 54(1, (1/2)): p. 23-31.

- 6Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 7Klein, A., Rechnungslegungstrends für Controller. 2012: Haufe Lexware.

- 8Bäckstrand, K., et al., Research Handbook on Climate Governance. Chapter 32: Carbon accounting. 2015: Edward Elgar Publishing.

- 9Schmidt, M., Carbon Accounting zwischen Modeerscheinung und ökologischem Verbesserungsprozess. Controlling & Management, 2010. 54: p. 32-37.

- 10Spannagle, M. A Comparison of ISO 14064 Part 1 and the GHG Protocol Corporate Module. 2004 [cited 2022 09-10]; Available from: https://www.ecologia.org/ems/ghg/news/cop9/comparison.html.

- 11GHG. About Us. 2022 [cited 2022 09-10]; Available from: https://ghgprotocol.org/about-us.

- 12WRI. Greenhouse Gas Protocol. 2022 [cited 2022 09-10]; Available from: https://www.wri.org/initiatives/greenhouse-gas-protocol.

- 13ISO. ISO 14064-1:2018: Greenhouse gases — Part 1. 2018 [cited 2022 09-13]; Available from: https://www.iso.org/standard/66453.html.

- 14Klein, A., Rechnungslegungstrends für Controller. 2012: Haufe Lexware.

- 15Breidenich, C., et al., The Kyoto Protocol to the United Nations Framework Convention on Climate Change. Am. j. int. law, 1998. 92(2): p. 315-331.

- 16Klein, A., Rechnungslegungstrends für Controller. 2012: Haufe Lexware.

- 17Schmidt, M., Carbon Accounting zwischen Modeerscheinung und ökologischem Verbesserungsprozess. Controlling & Management, 2010. 54: p. 32-37.

- 18He, R., et al., Corporate carbon accounting. Accounting and finance, 2022: p. 261-298.

- 19UNFCCC. History of the Convention. 2022 [cited 2022 09-10]; Available from: https://unfccc.int/process/the-convention/history-of-the-convention#eq-1.

- 20What is the United Nations Framework Convention on Climate Change? | UNFCCC. [cited 2022 09-14]; Available from: https://unfccc.int/process-and-meetings/the-convention/what-is-the-united-nations-framework-convention-on-climate-change.

- 21Ascui, F. and H. Lovell, As frames collide: making sense of carbon accounting. Accounting, Auditing & Accountability Journal, 2011. 24(8): p. 978-999.

- 22UNFCCC. History of the Convention. 2022 [cited 2022 09-10]; Available from: https://unfccc.int/process/the-convention/history-of-the-convention#eq-1.

- 23IPCC. History. 2022 [cited 2022 09-14]; Available from: https://www.ipcc.ch/about/history/.

- 24Csutora, M. and G. Harangozo, Twenty years of carbon accounting and auditing – a review and outlook. Society and Economy, 2017. 39(4): p. 459-480.

- 25Ratnatunga, J.T.D. and K.R. Balachandran, Carbon business accounting. Journal of accounting, auditing & finance, 2009.

- 26CDP. What CDP does. 2022 [cited 2022 09-07]; Available from: https://www.cdp.net/en/info/about-us/what-we-do.

- 27About Us | Greenhouse Gas Protocol. 2022 [cited 2022 09-12]; Available from: https://ghgprotocol.org/about-us.

- 28Csutora, M. and G. Harangozo, Twenty years of carbon accounting and auditing – a review and outlook. Society and Economy, 2017. 39(4): p. 459-480.

- 29Europäische Kommission. Climate Action – Übereinkommen von Paris. [cited 2022 09-14]; Available from: https://ec.europa.eu/clima/eu-action/international-action-climate-change/climate-negotiations/paris-agreement_de.

- 30Bebbington, J. and C. Larrinaga-González, Carbon Trading: Accounting and Reporting Issues. European Accounting Review, 2008. 17(4): p. 697-717.

- 31The World Bank. Pricing Carbon. 2014 [cited 2022 09-13]; Available from: https://www.worldbank.org/en/programs/pricing-carbon.

- 32Bäckstrand, K., et al., Research Handbook on Climate Governance. Chapter 32: Carbon accounting. 2015: Edward Elgar Publishing.

- 33Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 34Prevention, U.S.E.P.A.O.o.P., Toxics, and I. Incorporated, An Introduction to Environmental Accounting as a Business Management Tool: Key Concepts and Terms. 1995: U.S. Environmental Protection Agency, Office of Pollution Prevention and Toxics.

- 35Prevention, U.S.E.P.A.O.o.P., Toxics, and I. Incorporated, An Introduction to Environmental Accounting as a Business Management Tool: Key Concepts and Terms. 1995: U.S. Environmental Protection Agency, Office of Pollution Prevention and Toxics.

- 36Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 37Prevention, U.S.E.P.A.O.o.P., Toxics, and I. Incorporated, An Introduction to Environmental Accounting as a Business Management Tool: Key Concepts and Terms. 1995: U.S. Environmental Protection Agency, Office of Pollution Prevention and Toxics.

- 38Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 39Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 40Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 41Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 42Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 43Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 44Bäckstrand, K., et al., Research Handbook on Climate Governance. Chapter 32: Carbon accounting. 2015: Edward Elgar Publishing.

- 45Bäckstrand, K., et al., Research Handbook on Climate Governance. Chapter 32: Carbon accounting. 2015: Edward Elgar Publishing.

- 46Yamamoto, J. What Are Scope 1, 2, and 3 Emissions? A quick guide to the GHG Protocol for calculating your carbon footprint. 2022 [cited 2022 09-13]; Available from: https://www.onetrust.com/blog/what-are-scope-1-2-3-emissions/.

- 47Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 48Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 49About Us | Greenhouse Gas Protocol. 2022 [cited 2022 09-12]; Available from: https://ghgprotocol.org/about-us.

- 50Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 51ResourceCenter. What is the difference between direct and indirect emissions. 2016 [cited 2022 09-13]; Available from: https://www.buschsystems.com/resource-center/knowledgeBase/glossary/what-is-the-difference-between-direct-and-indirect-emissions.

- 52Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 53Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 54Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 55Stechemesser, K. and E. Guenther, Carbon accounting: a systematic literature review. Journal of Cleaner Production, 2012. 36: p. 17-38.

- 56Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 57Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 58Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 59Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 60Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 61Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 62Ranganathan, J. and P. Bhatia, The Greenhouse Gas Protocol: a Corporate Accounting and Reporting Standard, Revised Edition. 2004. 116.

- 63Wintergreen, J. and T. Delaney, ISO 14064, International Standard for GHG Emissions Inventories and Verification. 2007.

- 64DIN, DIN EN ISO 14064-1:2018. Treibhausgase –Teil 1: Spezifikation mit Anleitung zur quantitativen Bestimmung und Be-richterstattung von Treibhausgasemissionen und Entzug von Treibhausgasen auf Organisati-onsebene (ISO 14064-1:2018);. 2018, Beuth Verlag GmbH: Berlin.

- 65DIN, DIN EN ISO 14064-1:2018. Treibhausgase –Teil 1: Spezifikation mit Anleitung zur quantitativen Bestimmung und Be-richterstattung von Treibhausgasemissionen und Entzug von Treibhausgasen auf Organisati-onsebene (ISO 14064-1:2018);. 2018, Beuth Verlag GmbH: Berlin.

- 66DIN, DIN EN ISO 14064-1:2018. Treibhausgase –Teil 1: Spezifikation mit Anleitung zur quantitativen Bestimmung und Be-richterstattung von Treibhausgasemissionen und Entzug von Treibhausgasen auf Organisati-onsebene (ISO 14064-1:2018);. 2018, Beuth Verlag GmbH: Berlin.

- 67DIN, DIN EN ISO 14064-1:2018. Treibhausgase –Teil 1: Spezifikation mit Anleitung zur quantitativen Bestimmung und Be-richterstattung von Treibhausgasemissionen und Entzug von Treibhausgasen auf Organisati-onsebene (ISO 14064-1:2018);. 2018, Beuth Verlag GmbH: Berlin.

- 68Spannagle, M. A Comparison of ISO 14064 Part 1 and the GHG Protocol Corporate Module. 2004 [cited 2022 09-10]; Available from: https://www.ecologia.org/ems/ghg/news/cop9/comparison.html.